ICI Viewpoints

Savers Remain Focused on Retirement Goals Through Market Turbulence

US households felt the sting of high inflation in 2022. Sharp increases in consumer prices led to surging interest rates and a stock market downturn, driving steep losses in many investment accounts. This challenging environment generated financial headwinds to households of all income levels and elevated concerns over Americans’ retirement prospects.

Staying the Course

Despite turbulent financial conditions, American retirement plan savers stayed the course. According to ICI’s most recent survey of recordkeepers, only 2.5 percent of defined contribution (DC) plan participants stopped contributing to their plans last year, indicating disciplined savings habits through stretches of historic market volatility. While that figure represented a slight increase from one year earlier, it remained under pre-pandemic levels and well below those observed in 2008 and 2009, during the global financial crisis. Similarly, 401(k) loan activity edged up over the second half of 2022 but stayed near multidecade lows.

Total withdrawal activity also remained muted. Compared with 2021 data, the percentage of DC plan participants withdrawing account funds held steady at 4.1 percent, suggesting that Americans are committed to preserving their retirement nest eggs even during challenging times. The share of DC participants taking hardship withdrawals increased a bit from 1.7 percent in 2021 to 2.0 percent in 2022—still low in absolute terms.

Confidence Remained High

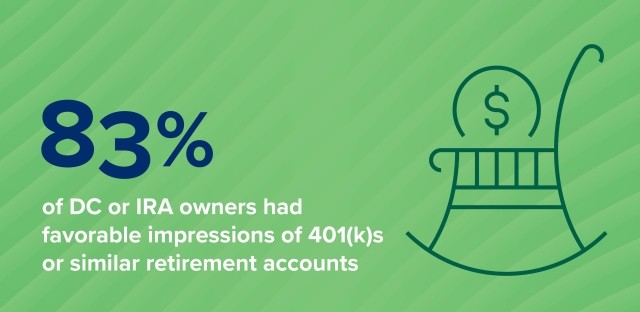

Not only were DC plan participants’ activities little changed in 2022 but an overwhelming majority of retirement savers maintained positive views of retirement plans. According to ICI’s 2022 American Views research survey, 83 percent of DC or individual retirement account (IRA) owners had favorable impressions of 401(k)s or similar retirement accounts. Additionally, nine out of 10 DC-owning individuals agreed that these plans helped them think about the long term and made it easier to save. Saving from every paycheck made roughly eight out of 10 DC-owning individuals less worried about the short-term performance of their investments.

Seventy-nine percent of DC or IRA owners indicated confidence in the ability of the 401(k) system to help individuals meet their retirement goals. That figure represented a modest decrease from the prior year—possibly the result of broad market performance.

New Savings Tools and Incentives

Thanks to several important provisions in the recently passed Secure 2.0 Act, employers will be able to offer new emergency savings tools within 401(k) plans to eligible employees. The law also promotes automatic enrollment in 401(k) and 403(b) plans, which seamlessly puts more workers on the road to retirement saving. Moreover, companies will be able to provide matching contributions to 401(k)s based on an employee’s student loan payments, incentivizing individuals to reduce their education debt and start saving earlier for retirement. Aimed to help retirees, an increase in the age at which withdrawals from retirement accounts must commence provides increased flexibility to preserve retirement savings even longer.

These key provisions could help strengthen opportunities for everyday Americans to achieve and maintain financial security and reinforce confidence in their retirement plans.

Individual investors and fund companies should be encouraged that savers’ retirement goals don’t get sidetracked due to events outside their control. Looking ahead, there are good reasons to be positive about US households’ savings habits and their longer-term retirement prospects.

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.