ICI Viewpoints

Navigating Through Financial Storms: American Savers’ Handling of Retirement Planning Through COVID

The onset and lingering effects of the global COVID-19 pandemic have created financial stresses throughout the US economy. Saving and investing are long-term goals, which can be disrupted by short-term financial storms. When household balance sheets shrink, some may be spurred to save more. On the other hand, precarious employment situations might reduce regular saving. Anxiety about the stock market might result in some investors rebalancing to be more conservative, while others see an opportunity to buy stocks during market dips. Financial stresses may also lead to changes in anticipated or actual retirement dates.

To explore these questions, ICI fielded a national survey in fall 2021 that asked respondents about any changes made to their saving, investing, or retirement date planning since the start of the COVID-19 pandemic.

The survey found that:

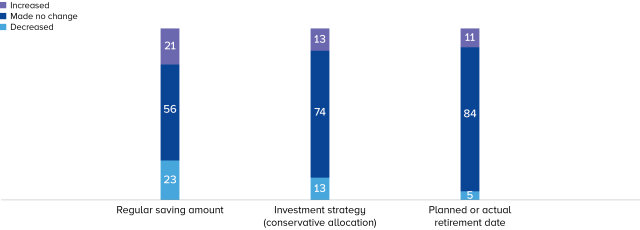

- More than half (56 percent) of individuals with savings and investments maintained their regular saving, while 21 percent managed to boost their regular saving activity.

- Nearly three-quarters (74 percent) of individuals with savings and investments maintained their investment strategy.

- More than eight in 10 (84 percent) of individuals with savings and investments maintained their anticipated or actual retirement age.

- Overall, nearly half (46 percent) of individuals with savings and investments made no changes across all three of these dimensions of their retirement planning—maintaining their regular saving, investment strategy, and retirement age (Figure 1).

Figure 1

Majority of American Savers Kept Plans on Track Through COVID-19

Percentage of US individuals with savings and investments, fall 2021

Note: Forty-six percent of individuals with savings and investments maintained their regular saving, investment strategy, and retirement date (see Figure 5).

Source: ICI tabulations of NORC AmeriSpeak® survey data (fall 2021)

These survey findings are consistent with the data ICI has published throughout the pandemic based on actions reported by DC plan recordkeepers.[1] The new survey results also find that older individuals with savings and investments tended to be more likely to stay the course, as did those with household incomes of $50,000 or more.[2]

Changes to Regular Saving

Seventy-seven percent of individuals with savings and investments continued to be committed to their regular saving despite the economic stresses of the COVID-19 pandemic (Figure 2). Overall, 56 percent of individuals with savings and investments indicated that they did not change the amount that they save regularly, and 21 percent indicated they had increased their regular saving amounts. Twenty-three percent of individuals indicated that they were saving less as a result of the financial turmoil of the past two years. The fraction reporting saving less is the highest among those aged 35 to 49 (30 percent), compared with individuals aged 50 to 64 (22 percent) and individuals aged 65 or older (13 percent). Older individuals were more likely to report no change in saving compared with younger individuals—48 percent for individuals younger than 35 versus 76 percent for individuals aged 65 or older.

Changes in regular saving activity also varied across income groups. Thirty-one percent of individuals with savings and investments earning less than $30,000 in household income reported they had reduced their regular saving amount as a result of the economic stresses of COVID-19, while only about 20 percent of individuals earning $50,000 or more did so (Figure 2). This is offset mostly by those who reported no change in saving—49 percent for individuals with savings and investments earning less than $30,000 and rising to 59 percent for individuals earning $100,000 or more.

Figure 2

Change in Regular Saving in Response to COVID-19

Percentage of US individuals with savings and investments, fall 2021

| Age of respondent | |||||

| All individuals | Younger than 35 | 35 to 49 | 50 to 64 | 65 or older | |

| Increased regular saving amount | 21 | 27 | 26 | 19 | 11 |

| Made no change in regular saving amount | 56 | 48 | 44 | 59 | 76 |

| Decreased regular saving amount | 23 | 25 | 30 | 22 | 13 |

| Household income | |||||

| All individuals | Less than $30,000 | $30,000 to $49,999 | $50,000 to $99,999 | $100,000 or more | |

| Increased regular saving amount | 21 | 20 | 22 | 24 | 20 |

| Made no change in regular saving amount | 56 | 49 | 47 | 57 | 59 |

| Decreased regular saving amount | 23 | 31 | 31 | 19 | 21 |

Source: ICI tabulations of NORC AmeriSpeak® survey data (fall 2021)

Changes to Investment Strategy

The survey also asked individuals with savings and investments if they had changed their investment strategy in response to the economic stresses of the COVID-19 pandemic. Nearly three-quarters (74 percent) of individuals with savings and investments indicated they made no change in their investment strategy over the past two years (Figure 3). Among individuals making changes, half shifted their investments to be more conservative (overall, 13 percent)[3] and the other half shifted their investments to be less conservative (overall, 13 percent).

Younger individuals with savings and investments were more likely to report activity and were more likely to shift investments to be less conservative, compared with other age groups. Twenty-one percent of individuals younger than 35 with savings and investments had shifted investments to be less conservative in the past two years, while 63 percent had made no change in their investment strategy, and 16 percent had shifted investments to be more conservative (Figure 3). In contrast, in the oldest age group, 6 percent had shifted investments to be less conservative, 81 percent made no change, and 13 percent had shifted investments to be more conservative.

Figure 3

Change in Investment Strategy in Response to COVID-19

Percentage of US individuals with savings and investments, fall 2021

| Age of respondent | |||||

| All individuals | Younger than 35 | 35 to 49 | 50 to 64 | 65 or older | |

| Shifted investments to be more conservative | 13 | 16 | 11 | 13 | 13 |

| Made no change in investment strategy | 74 | 63 | 74 | 79 | 81 |

| Shifted investments to be less conservative | 13 | 21 | 15 | 8 | 6 |

| Household income | |||||

| All individuals | Less than $30,000 | $30,000 to $49,999 | $50,000 to $99,999 | $100,000 or more | |

| Shifted investments to be more conservative | 13 | 16 | 12 | 15 | 13 |

| Made no change in investment strategy | 74 | 67 | 71 | 76 | 74 |

| Shifted investments to be less conservative | 13 | 17 | 17 | 9 | 13 |

Source: ICI tabulations of NORC AmeriSpeak® survey data (fall 2021)

Changes to Retirement Age

Another adjustment that might be made to retirement planning involves the expected or actual retirement date. Overall, 84 percent of individuals with savings and investments made no change in their retirement plans; 11 percent delayed taking retirement or increased their expected retirement age, and 5 percent took early retirement or lowered their expected retirement age (Figure 4).[4]

The youngest individuals with savings and investments were the most likely to say they increased their retirement age (17 percent did so), compared with about one in 10 increasing their retirement age among those aged 35 to 64 (Figure 4). Changes to retirement plans varied by household income, with 87 percent of individuals with savings and investments and household incomes of $100,000 or more indicating no change in plans, compared with 68 percent of those with household incomes of less than $30,000. Eleven percent of individuals with savings and investments and household income less than $30,000 indicated they took early retirement or lowered their expected retirement age, compared with less than one in 10 among higher-income individuals.

Figure 4

Change in Retirement Age in Response to COVID-19

Percentage of US individuals with savings and investments, fall 2021

| Age of respondent | |||||

| All individuals | Younger than 35 | 35 to 49 | 50 to 64 | 65 or older | |

| Delayed taking retirement or increased expected retirement age | 11 | 17 | 9 | 12 | 3 |

| Made no change in retirement plans | 84 | 78 | 90 | 81 | 89 |

| Took early retirement or lowered expected retirement age | 5 | 5 | 1 | 7 | 8 |

| Household income | |||||

| All individuals | Less than $30,000 | $30,000 to $49,999 | $50,000 to $99,999 | $100,000 or more | |

| Delayed taking retirement or increased expected retirement age | 11 | 21 | 14 | 8 | 9 |

| Made no change in retirement plans | 84 | 68 | 81 | 86 | 87 |

| Took early retirement or lowered expected retirement age | 5 | 11 | 5 | 6 | 4 |

Source: ICI tabulations of NORC AmeriSpeak® survey data (fall 2021)

Forty-Six Percent Made No Changes

Looking across all three possible adjustments considered—regular saving, investment strategy, and retirement age—46 percent of individuals with savings and investments made no adjustments (Figure 5). Nine percent made changes across all three dimensions, while 31 percent chose to make one adjustment and 14 percent chose to make two adjustments. Older individuals were the most likely to stay the course with no changes, as were those with $50,000 or more in household income.

Figure 5

Number of Changes Made in Response to COVID-19

Percentage of US individuals with savings and investments, fall 2021

| Age of respondent | |||||

| Number of changes | All individuals | Younger than 35 | 35 to 49 | 50 to 64 | 65 or older |

| Zero | 46 | 37 | 37 | 48 | 65 |

| One | 31 | 32 | 39 | 31 | 20 |

| Two | 14 | 15 | 17 | 13 | 11 |

| Three | 9 | 16 | 7 | 8 | 4 |

| Household income | |||||

| Number of changes | All individuals | Less than $30,000 | $30,000 to $49,999 | $50,000 to $99,999 | $100,000 or more |

| Zero | 46 | 41 | 38 | 48 | 47 |

| One | 31 | 25 | 33 | 29 | 33 |

| Two | 14 | 11 | 19 | 16 | 13 |

| Three | 9 | 23 | 10 | 7 | 7 |

Note: Households are counted as having made changes if they changed their regular savings amounts; changed their investments to be more or less conservative; or took early retirement, delayed retirement, or changed their expected retirement date.

Source: ICI tabulations of NORC AmeriSpeak® survey data (fall 2021)

More About the Survey

The AmeriSpeak® panel is designed to be representative of individuals aged 18 or older in the United States. Initially, randomly selected US households are sampled with a known, nonzero probability of selection from the NORC National Frame, and then contacted by US mail, telephone interviewers, overnight express mailers, or field interviewers (face to face). The NORC National Frame is representative of more than 97 percent of US households and includes additional coverage of population segments that are hard to survey, such as rural and low-income households. Panelists may participate in two to three AmeriSpeak® panel studies per month by phone or online (by computer, tablet, or smartphone). This survey was fielded in November and December 2021, covering a total sample of 2,041 individuals aged 18 or older in the United States. Of the individuals surveyed, 1,629 households, or 80 percent, had savings and investments. Survey results are weighted to be representative of the total population of Americans aged 18 or older. The margin of error for the sample of individuals with savings and investments is ± 2.4 percentage points at the 95 percent confidence level.

Notes

[1] ICI’s Defined Contribution Plan Recordkeeper Survey also monitored defined contribution (DC) plan participants’ activities through the pandemic. In that time, DC plan participants have generally stayed the course with their contributions and asset allocations, and a minority of DC plan participants have tapped their accounts with withdrawals or loans. Additionally, in fall 2021, ICI surveyed Americans about their financial response to COVID-19.

[2] ICI’s fall 2010 survey contained the same battery of questions, asking respondents to think about whether they had changed their approach to saving, investing, and retirement planning over the prior three years as a result of the weak economy and volatile stock market during the 2007–2009 global financial crisis. In fall 2010, majorities of households with retirement accounts or other financial investments remained committed to saving, their investment strategies, or retirement dates, even during those years of financial stress.

[3] In this context, more conservative means that an investor is shifting away from stocks and toward bonds, cash, or money market funds.

[4] This question was asked of all survey respondents. Across all individuals surveyed: 81 percent made no change in their retirement plans, 11 percent delayed taking retirement or increased their expected retirement age, and 8 percent took early retirement or lowered their expected retirement age.

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.

Daniel Schrass is an Economist at ICI.