News Release

Latest Research Shows UCITS Charges Continue to Fall

Washington, DC; October 31, 2022—Average ongoing charges for UCITS in the European Union continued to fall in 2021, the latest ICI research shows. Ongoing charges are indirectly paid from fund assets and cover a range of services, including portfolio management, compliance costs, and more. They have generally declined since 2013.

“UCITS have a three-decade track record as a thriving European investment product, and the strong UCITS regulatory framework has allowed these funds to be distributed across the globe,” said Eva Mykolenko, Associate Chief Counsel at ICI Global. “With nearly €13 trillion assets invested globally, UCITS are a valuable and cost-effective tool for investors looking to invest and save over the long-term to meet their financial goals.”

As the report illustrates, average ongoing charges for equity UCITS fell 19 percent between 2013 and 2021—falling from 1.49 percent in 2013 to 1.21 percent in 2021. For fixed-income UCITS, the average ongoing charge declined 31 percent—from 0.98 percent in 2013 to 0.68 percent in 2021.

“Our research shows that average ongoing charges, for equity and fixed-income UCITS, continue to fall,” said James Duvall, ICI Economist. “Retail investors can benefit from these lower ongoing charges, and with average ongoing charges for new UCITS trending downward, UCITS are poised to maintain their success across Europe.”

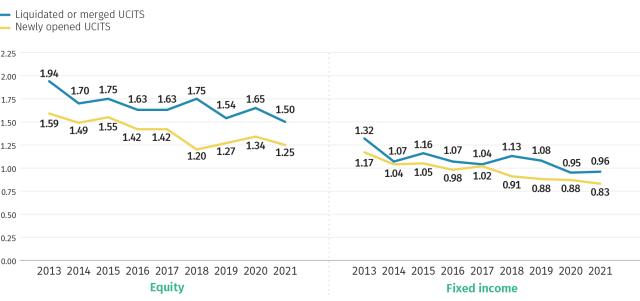

The entry of lower-cost funds and the exit of higher cost funds has likely contributed to the downward pressure on average ongoing charges. Since 2013, simple average ongoing charges for newly opened funds have trended down (see chart below). New unbundled share classes and index tracking UCITS, which generally have lower ongoing charges, have met increased demand by investors for lower-cost products. At the same time, simple average ongoing charges for funds exiting the industry by liquidating or merging were higher than those of newly opened funds in the same year.

Simple Average Ongoing Charges of Newly Opened UCITS Have Trended Downward

Percent

Note: Data exclude exchange-traded funds.

Source: Investment Company Institute calculations of Morningstar Direct data

Other key findings include:

- Average ongoing charges decreased in 2021. The average ongoing charge for equity UCITS fell 3 basis points from 1.24 percent in 2020 to 1.21 percent in 2021; and the average ongoing charge for fixed-income UCITS fell 4 basis points from 0.72 to 0.68 percent over the same period.

- Investors tend to concentrate their assets in lower-cost UCITS. In 2021, the simple average ongoing charge for all equity UCITS was 1.42 percent, compared with an asset-weighted average of 1.21 percent.

- Retail investors still pay for the cost of distribution even when it is not included in the total ongoing charge. Direct comparisons of average ongoing charges between UCITS share classes that “bundle” distribution in the ongoing charge with those that “unbundle” distribution from the ongoing charge can be misleading. In unbundled share classes, retail investors typically pay distribution costs directly out of pocket.

- Average ongoing charges for equity and fixed income UCITS ETFs decreased in 2021. The average ongoing charge of equity UCITS ETFs fell from 0.25 percent in 2020 to 0.23 percent in 2021. Over the same period, the average ongoing charge for fixed income UCITS ETFs decreased from 0.26 percent to 0.23 percent.

To read more from the study, click here.