ICI Viewpoints

Americans’ Financial Response to COVID

Since the onset of the COVID-19 pandemic in spring 2020, American households faced numerous disruptions and financial stress. In March 2020, policymakers acted to allow easier access to retirement accounts to help Americans impacted by COVID-19 through the difficult financial times. The Coronavirus Aid, Relief, and Economic Security (CARES) Act provided penalty relief on withdrawals taken from retirement accounts and expanded flexibility in retirement plan withdrawals and loans.[1]

Throughout the pandemic, ICI sought to understand how Americans responded to these relief efforts, by (1) specifically asking if Americans tapped their retirement accounts, and (2) analyzing defined contribution (DC) retirement plan participants’ contribution, asset allocation, withdrawal, and loan activity.

Together, these two sets of data—self-reported actions from the surveys and administrative recordkeeper data based on actual DC account activity—contradict claims that large numbers of savers turned to withdrawals or loans from retirement plans in response to COVID-19 financial stress. To the contrary, Americans appear to have placed a high priority on preserving their retirement savings.

Majority of Americans Did Not Take Financial Actions Because of COVID-19

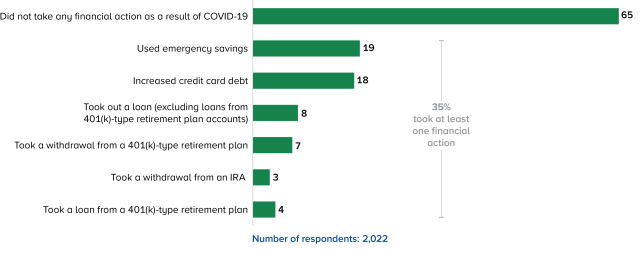

In fall 2021, ICI asked Americans to think about financial actions they took because of COVID-19.[2] Figure 1 presents the results in a nutshell:

- A strong majority (65 percent) of US individuals did not take financial actions because of COVID-19.

- Among the 35 percent that took actions, the most common action was to use emergency savings (reported by 19 percent of individuals), and to increase credit card debt (18 percent of individuals). Eight percent increased other debt (excluding loans from 401(k)-type retirement plan accounts).

- The least common actions were to draw from retirement accounts, with only 7 percent of individuals taking withdrawals from 401(k)-type retirement plan accounts; 3 percent taking withdrawals from individual retirement accounts (IRAs); and 4 percent taking loans from 401(k)-type retirement plan accounts because of COVID-19.

FIGURE 1

Impact of COVID-19 on US Household Finances

Percentage of US individuals, fall 2021

Note: Multiple responses are included for respondents who took financial action as a result of COVID-19.

Source: ICI tabulation of NORC AmeriSpeak® survey data (fall 2021)

The survey findings are consistent with responses collected in 2020[3] and data that ICI published throughout the pandemic based on actions reported by DC plan recordkeepers.[4] Throughout the pandemic, DC plan participants generally stayed the course with their contributions and asset allocations, with a minority of DC plan participants tapping their accounts with withdrawals or loans.[5]

Americans Carefully Use Financial Safety Valves

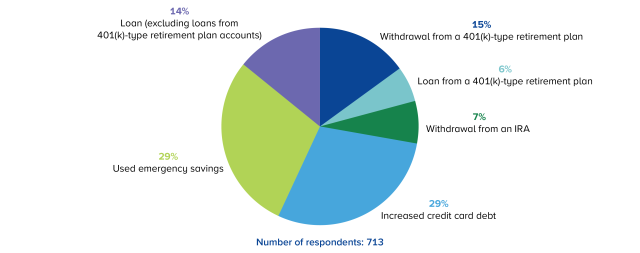

The 2021 survey finds 35 percent of Americans taking at least one of the following financial actions because of the pandemic: tapping emergency savings, increasing credit card or other debt, or taking withdrawals or loans from retirement accounts (Figure 1).

The 35 percent of individuals taking financial actions then reported which action involved the most money. Twenty-nine percent of people taking financial actions said that emergency savings involved the most money, and another 29 percent said that credit card debt did (Figure 2). Another 15 percent said withdrawals from a 401(k)-type retirement plan involved the most money, and 14 percent pointed to nonretirement plan loans. Finally, 7 percent of those taking financial actions noted IRA withdrawals involved the most money, and 6 percent pointed to 401(k)-type retirement plan loans.

FIGURE 2

Financial Response to COVID-19 Involving the Most Money

Percentage of US individuals taking financial action as a result of COVID-19, fall 2021

Source: ICI tabulation of NORC AmeriSpeak® survey data (fall 2021)

As seen in past instances of financial turmoil and market volatility—such as the global financial crisis of 2007 through 2009—retirement savers seem to initiate a financial triage to address financial pressures. In many cases, other safety valves such as emergency funds are used first—tapping retirement savings tends to be viewed as a last resort. These survey results are consistent with that pattern. It’s clear that Americans view retirement savings as a special bucket set aside for their golden years.

More About the Survey

The AmeriSpeak® panel is designed to be representative of individuals aged 18 or older in the United States. Initially, randomly selected US households are sampled with a known, nonzero probability of selection from the NORC National Frame, and then contacted by US mail, telephone interviewers, overnight express mailers, or field interviewers (face to face). The NORC National Frame is representative of more than 97 percent of US households and includes additional coverage of population segments that are hard to survey, such as rural and low-income households. Panelists may participate in two to three AmeriSpeak® panel studies per month by phone or online (by computer, tablet, or smartphone). This survey was fielded in November and December 2021, covering a total sample of 2,041 individuals aged 18 or older in the United States. Survey results are weighted to be representative of the total population of Americans aged 18 or older. The margin of error for the sample is ± 2.2 percentage points at the 95 percent confidence level.

Notes

[1] The CARES Act contained provisions to provide penalty relief for taxpayers affected by COVID-19 taking early withdrawals from retirement accounts, as well as optional DC retirement plan provisions to expand availability of in-service distributions for those affected by COVID-19, allow repayment of coronavirus-related distributions (CRDs), increase the amount available for a plan loan, and add flexibility in repayment of plan loans. For details, see Internal Revenue Service, “Coronavirus-Related Relief for Retirement Plans and IRAs: Questions and Answers.”

[2] To gain a broader understanding of how Americans have reacted financially to the COVID-19 pandemic, in late November and early December 2021, ICI Research fielded two survey questions to the AmeriSpeak® research panel, a probability-based survey panel designed and operated by NORC at the University of Chicago. ICI fielded the same questions in fall 2020, which found similar results. See Sarah Holden and Daniel Schrass, “Survey Confirms: Despite COVID-19, Retirement Savers Protect Their Accounts,” ICI Viewpoints (February 2021).

[3] See note 2.

[4] See Sarah Holden, Daniel Schrass, and Elena Barone Chism, “Defined Contribution Plan Participants’ Activities, 2020,” ICI Research Report (February 2021); and Sarah Holden, Daniel Schrass, and Elena Barone Chism, “Defined Contribution Plan Participants’ Activities, First Three Quarters 2021,” ICI Research Report (February 2022).

[5] During 2020, DC plan recordkeepers identified 5.8 percent of DC plan participants as taking CARES Act CRDs, which participants can repay. A CRD is any distribution from an eligible retirement plan (up to an aggregate limit of $100,000) made on or after January 1, 2020, and before December 31, 2020, to a qualified individual affected by COVID-19. In 2020, 3.8 percent of DC plan participants took withdrawals, with 1.4 percent of DC plan participants taking hardship withdrawals during 2020. See Holden, Schrass, and Chism 2021.

Sarah Holden is the Senior Director of Retirement and Investor Research at ICI.

Daniel Schrass is an Economist at ICI.