Frequently Asked Questions About Mutual Fund Shareholders

How many American households own mutual funds?

How would you describe the average household owning mutual funds?

Why do households invest in mutual funds?

How significant are mutual funds to US households’ financial holdings?

What types of mutual funds do people own?

How much financial risk are mutual fund shareholders willing to take?

How many years have US households owned mutual funds?

How are US households introduced to mutual funds?

How do most US households purchase mutual funds?

How does ICI gather information about mutual fund shareholders?

Where can I get more information about mutual fund shareholders?

How many American households own mutual funds?

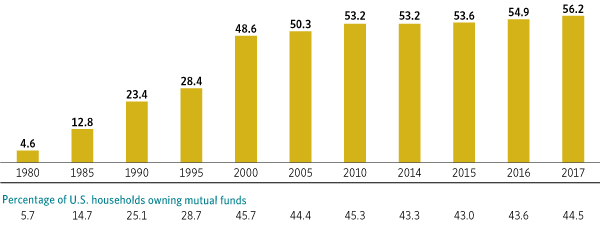

In mid-2017, an estimated 56.2 million households, or 44.5 percent of all US households, owned mutual funds. The current estimate of the number of individual investors owning mutual funds is 100.0 million.

US Household Ownership of Mutual Funds

Millions, selected years

Sources: Investment Company Institute and US Census Bureau

How would you describe the average household owning mutual funds?

In 2017, the “typical” mutual fund–owning head of household:

- was middle-aged, employed, educated, married or living with a partner, and shared investment decision-making with his or her spouse or partner;

- was of moderate financial means, with $100,000 in household income and $200,000 in household financial assets;

- owned investments other than mutual funds, including individual stocks, and had over half of the household’s financial assets (excluding the primary residence) invested in mutual funds;

- had $120,000 invested in three mutual funds, including at least one equity fund;

- owned mutual funds inside an employer-sponsored retirement plan, such as a 401(k) plan, 403(b) plan, 457 plan, SEP IRA, SAR-SEP IRA, or SIMPLE IRA;

- also owned mutual funds outside employer-sponsored retirement plans, primarily purchased through investment professionals (e.g., registered investment advisers, full-service brokers, independent financial planners, bank or savings institution representatives, insurance agents, or accountants); and

- was confident that mutual funds could help him or her reach financial goals.

Multiple generations of Americans own mutual funds. In mid-2017, 20 percent of individuals heading households that owned mutual funds were members of the Millennial Generation, who were born between 1981 and 2004. Thirty-three percent were members of Generation X, those born between 1965 and 1980. The Baby Boom Generation (those born between 1946 and 1964) made up the largest proportion—37 percent—of individuals heading mutual fund–owning households. The remaining 10 percent of individuals heading mutual fund–owning households were members of the Silent and GI Generations (born between 1904 and 1945).

Why do households invest in mutual funds?

Mutual fund–owning households have a variety of financial goals for their mutual fund investments. In mid-2017, the vast majority (92 percent) indicated they were using mutual funds to save for retirement; 75 percent indicated that saving for retirement was their household’s primary financial goal. Many mutual fund–owning households (52.9 million) held funds in tax-deferred savings accounts. Nevertheless, 15.3 million US households held mutual funds in taxable accounts in 2017.

Retirement is not the only financial goal for households’ mutual fund investments. About half (49 percent) of mutual fund–owning households reported that reducing their taxable income was one of their goals; 47 percent listed saving for an emergency as a goal; and 23 percent reported saving for education among their goals.

How significant are mutual funds to US households’ financial holdings?

Mutual funds represented a significant component of many US households’ financial holdings in mid-2017. Among households owning mutual funds, the median amount invested in mutual funds was $120,000. Mutual fund holdings represented more than half of household financial assets for 65 percent of households that owned mutual funds.

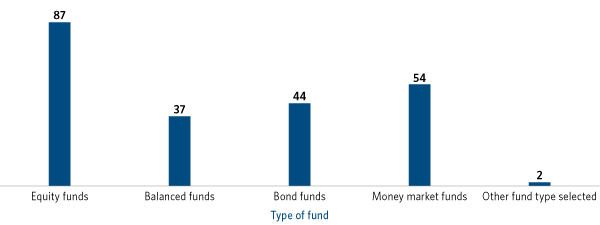

What types of mutual funds do people own?

In mid-2017, the typical mutual fund–owning household had $120,000 invested in three mutual funds, including at least one equity fund. Equity funds were the most commonly owned type of mutual fund, held by 87 percent of mutual fund–owning households. Thirty-seven percent owned balanced funds, 44 percent owned bond funds, and 54 percent owned money market funds. In addition, 39 percent of mutual fund–owning households owned global or international stock funds.

Equity Funds Are the Most Commonly Owned Mutual Fund

Percentage of US households owning mutual funds, 2017

Note: Multiple responses are included.

Source: Investment Company Institute Annual Mutual Fund Shareholder Tracking Survey

How much financial risk are mutual fund shareholders willing to take?

Mutual funds represented a significant component of many U.S. households’ financial holdings in mid-2017. Among households owning mutual funds, the median amount invested in mutual funds was $120,000. Mutual fund holdings represented more than half of household financial assets for 65 percent of households that owned mutual funds.

How many years have US households owned mutual funds?

The vast majority of mutual fund–owning households have invested in mutual funds for many years. In mid-2017, 25 percent had bought their first mutual fund before 1990; 12 percent had purchased their first fund between 1990 and 1994; 16 percent had bought their first fund between 1995 and 1999; and 14 percent had bought their first fund between 2000 and 2004. Thirty-three percent had bought their first fund in 2005 or later.

How are US households introduced to mutual funds?

Mutual fund–owning households often purchase their first mutual fund through employer-sponsored retirement plans: 63 percent purchased their first fund through that channel. Households that made their first mutual fund purchase more recently were more likely to have done so through employer-sponsored retirement plans. Among households that bought their first mutual fund in 2010 or later, 78 percent bought that first fund through such a plan, compared with 49 percent of households that first purchased mutual funds before 1990.

Employer-Sponsored Retirement Plans Are Increasingly the Source of First Fund Purchase

Percentage of US households owning mutual funds, 2017

|

|

Year of household’s first mutual fund purchase |

||||||||||

|

Before |

Between 1990 |

Between 1995 |

Between 2000 |

Between 2005 and 2009 |

2010 or later |

Memo: |

|||||

| Source of first mutual fund purchase | |||||||||||

| Inside employer-sponsored retirement plan | 49 | 61 | 66 | 64 | 62 | 78 | 63 | ||||

| Outside employer-sponsored retirement plan | 51 | 39 | 34 | 36 | 38 | 22 | 37 | ||||

Note: Employer-sponsored retirement plans include DC plans (such as 401(k), 403(b), or 457 plans) and employer-sponsored IRAs (SEP IRAs, SAR-SEP IRAs, and SIMPLE IRAs).

Source: Investment Company Institute Annual Mutual Fund Shareholder Tracking Survey

How do most US households purchase mutual funds?

In mid-2017, 81 percent of mutual fund–owning households owned funds through employer-sponsored retirement plans. Sixty-four percent of mutual fund–owning households owned mutual funds purchased outside employer-sponsored retirement plans. Among these households, half owned mutual funds purchased from the sales force channel, which includes registered investment advisers, full-service brokers, independent financial planners, bank or savings institution representatives, insurance agents, and accountants; and 36 percent owned fund shares purchased from the direct market channel, which consists of purchases made directly from fund companies and through discount brokers.

Sixty percent of mutual fund–owning households considered employer-sponsored retirement plans to be their primary source for purchasing mutual funds. Twenty-eight percent reported the sales force channel to be their primary source for purchasing funds, and 12 percent cited the direct market channel.

How does ICI gather information about mutual fund shareholders?

ICI conducts the Annual Mutual Fund Shareholder Tracking Survey each spring to gather information on the demographic and financial characteristics of mutual fund–owning households in the United States. The most recent survey was conducted from May to July 2017 and was based on a dual frame telephone sample of 5,000 randomly selected US households. Of these, 2,500 households were from a landline random digit dial (RDD) frame and 2,500 households were from a cell phone RDD frame. Of the households contacted, 2,223 (44.5 percent) owned mutual funds. Eligible households included those owning mutual funds inside or outside employer-sponsored retirement plans. All interviews were conducted over the telephone with the member of the household who was the sole or co-decisionmaker most knowledgeable about the household’s savings and investments.

Where can I get more information about mutual fund shareholders?

For more information about mutual fund shareholders, please see the following ICI publications:

- Ownership of Mutual Funds, Shareholder Sentiment, and Use of the Internet, 2017 (pdf)

- Characteristics of Mutual Fund Investors, 2017 (pdf)

- Profile of Mutual Fund Shareholders, 2017 (pdf)

- Investment Company Fact Book: A Review of Trends and Activity in the Investment Company Industry

March 2018